defer capital gains tax australia

To get around the capital gains tax you need to live in your primary residence at least two of the five years before you sell it. Market valuation for tax purposes.

Foreign Companies Expat Tax Professionals

Establish the date you buy or acquire an asset your share of ownership and records to keep.

. Receive a full exemption from any capital gains tax on all future capital gains from the invested funds if the investment is held for at least 10 years. A capital gains tax CGT was introduced in Australia on 20 September 1985 one of a number of tax reforms by the Hawke Keating government. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange.

This is the difference between what it cost you and what you get when you sell or dispose of it. In this case a. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

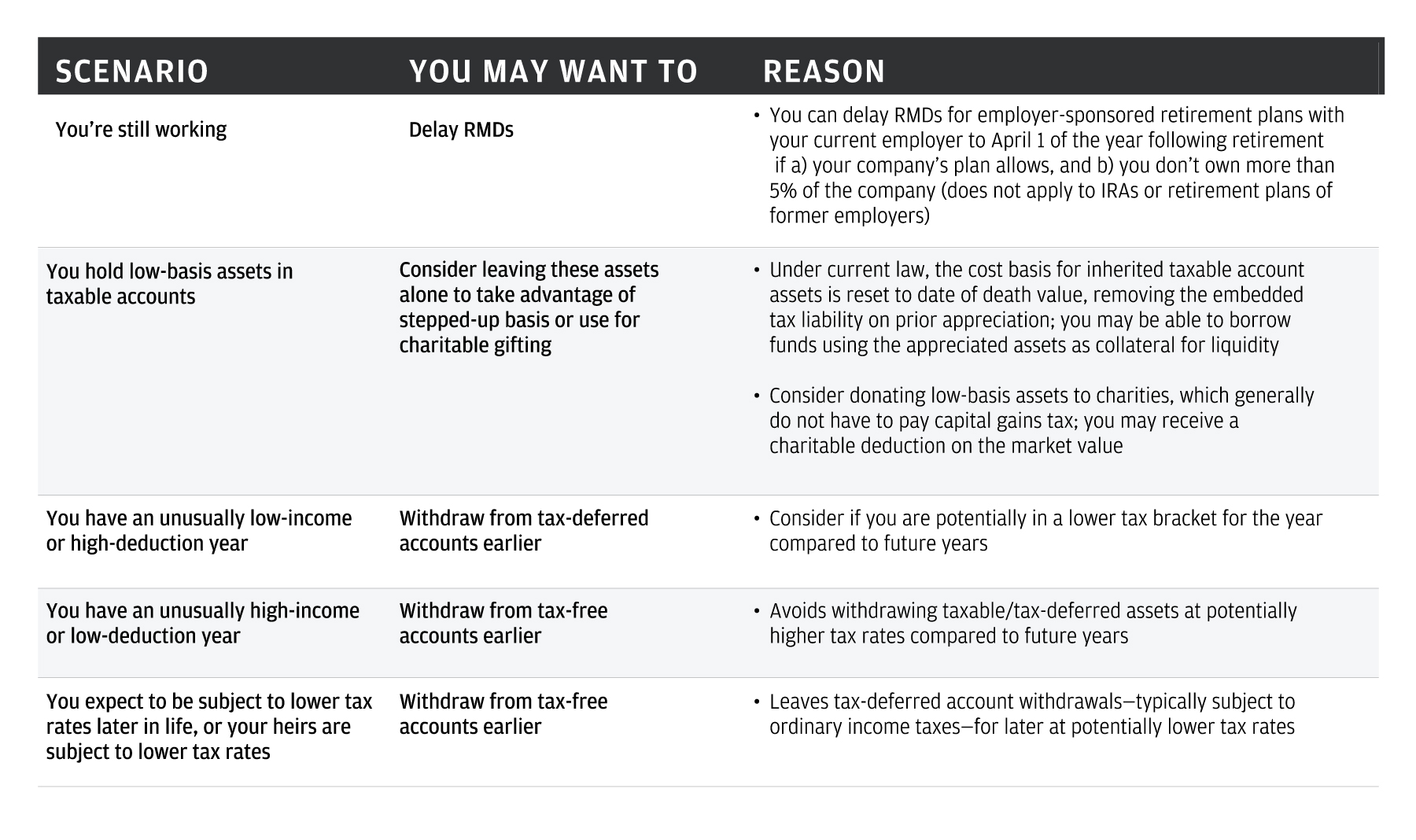

CGT is the tax that you pay on any capital gain. Trust non-assessable payments CGT event E4. The small business capital gains tax CGT concessions allow you to reduce disregard or defer some or all of a capital gain from an active asset used in a small business.

Foreign resident capital gains withholding. If the property you are selling is your main residence the gain is not subject to CGT. The CGT applied only to assets acquired on or after that date with gains or losses on assets owned on that date called pre-CGT assets not being subject to the CGT.

Skip to primary navigation. Capital gains withholding - Impacts on foreign and Australian residents. This deferral occurs because the property owner makes a profit from one property and puts it directly into another so the profit isnt fully realized and is insusceptible to taxation.

If you have to complete a CGT schedule you may need to provide information regarding the capital gains reduced or disregarded. At the moment the Australian Capital Gains Tax rate is 125 per cent and expats could be hit with it if they try to sell their home in Australia after these new tax rules come into affect on 1 July 2020. However the exemption may not fully apply if the residence has been used to produce income.

1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. However the Tax Cut and Jobs Act TCJA which took effect on Jan. If your business sells an asset such as property you usually make a capital gain or loss.

The 4 small business CGT concessions. Contact a Fidelity Advisor. Can You Defer Capital Gains Tax In Australia.

A Tax-deferred rate will be determined for each financial year eg. Check if your assets are subject to CGT exempt or pre-date CGT. The deferral is in effect until the QOF investment is sold or exchanged or on Dec.

Of the investment for the purpose of calculating an investors Capital Gains. The Federal Government has made changes to Australian Capital Gains Tax for. There can be a big difference in the rate so it may make sense for some investors to wait at least one year before selling a property.

The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. One year is the dividing line between having to pay short term versus long term capital gains tax. Theyll consider all the options and help you prevent or reduce the amount you are liable to pay.

A 1031 exchange refers to IRS Section 1031 which involves a capital gains tax deferral when a property owner completes a like-kind exchange. How long do I need to live in a house to avoid capital gains tax Australia. How much is capital gains tax in Australia.

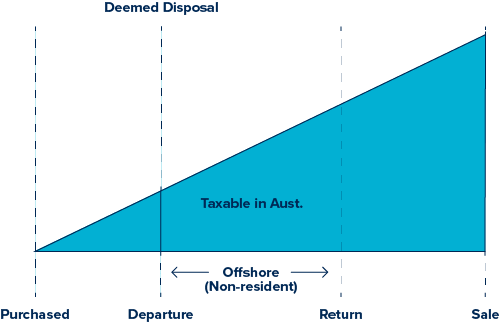

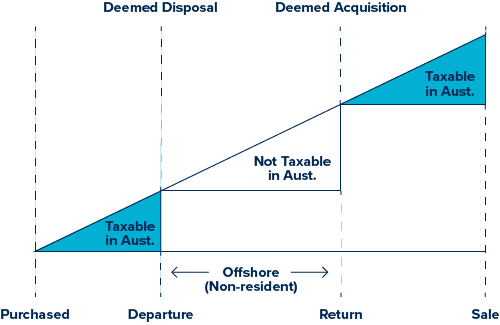

Leaving Australia means capital gains tax can arise - CGT Event I1 - as there is a deemed disposal of investments at their market value. Capital gains withholding - for real estate agents. Sell the Property After 1 Year.

As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are not actually tax-free. The concessions are available when you dispose of an active asset and meet eligibility requirements. Learn about capital gains tax CGT what a CGT event is and ways to reduce your capital gain.

How and when CGT is triggered such as when an asset is sold lost or destroyed. CGT for specific investment products. 31 2026 whichever comes first.

Defer capital gains tax australia. To defer taxation on income or gains relating to property which would otherwise be taxed in that State upon the individual ceasing to be a resident of that State for the purposes. Defer capital gains tax australia Thursday June 23 2022 Edit.

Capital gains withholding - a guide for conveyancers. The investor is then exempt from income tax for that proportion of the income distributions they have received from the fund on a tax-deferred basis in the. Use the main residence exemption.

Short term capital gains are taxed as ordinary income. If you want to stick with real estate when reinvesting your capital gains look for Opportunity Zone Funds that buy older buildings in Opportunity Zones renovate them at a reinvestment cost. Rather it is deferred into another property.

See Part B for individuals or Part C for companies trusts and funds. There are exemptions and rollovers that may allow you to reduce defer or disregard your capital gain or capital loss. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

The investor is then exempt from income tax for that proportion of the income distributions they have received from the fund on a tax-deferred basis in the same financial year. Defer capital gains tax australia Monday June 20 2022 Edit.

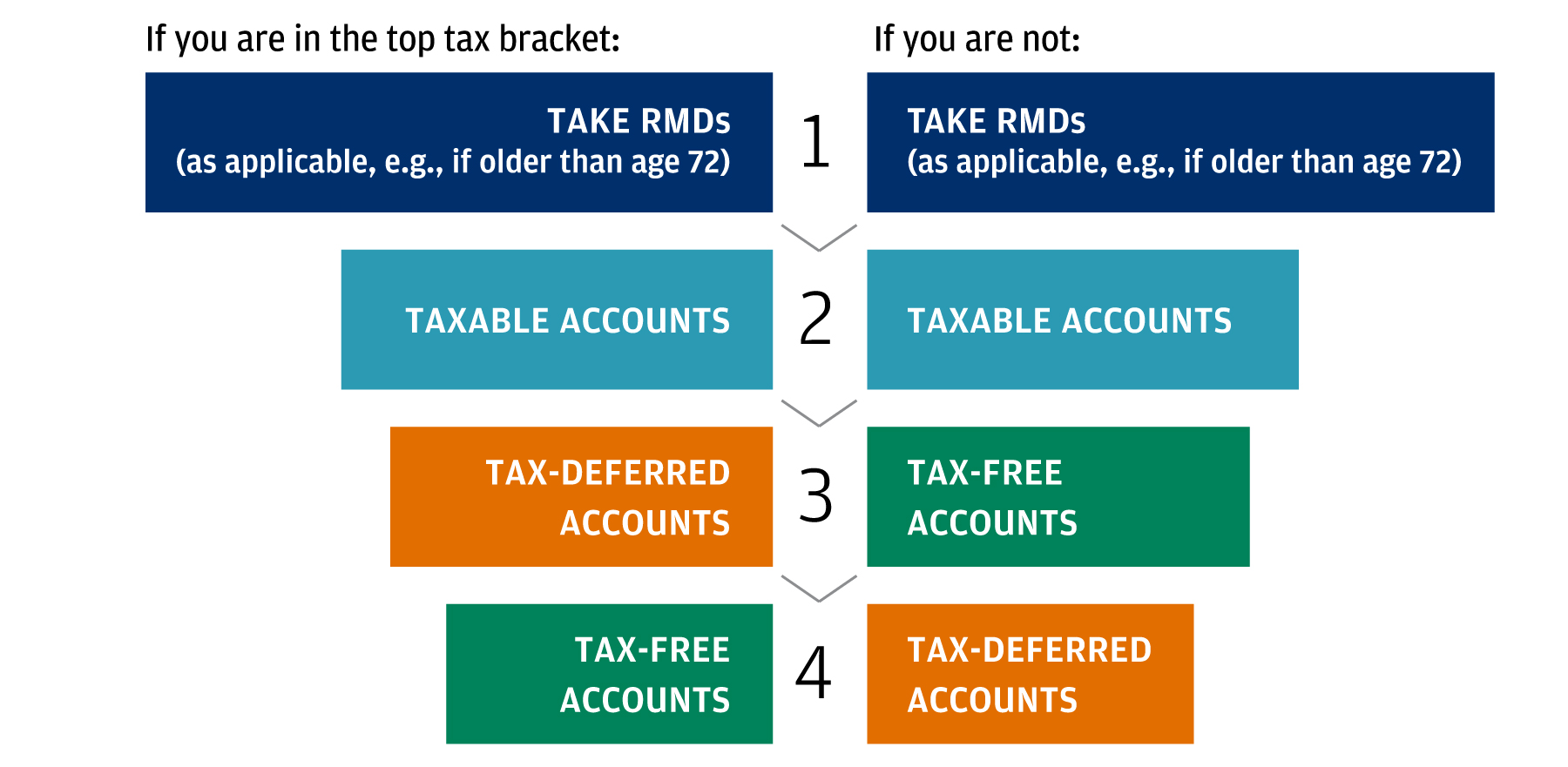

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

What Is A Deemed Disposal Atlas Wealth Management

What Are The New Capital Gains Rates For 2022

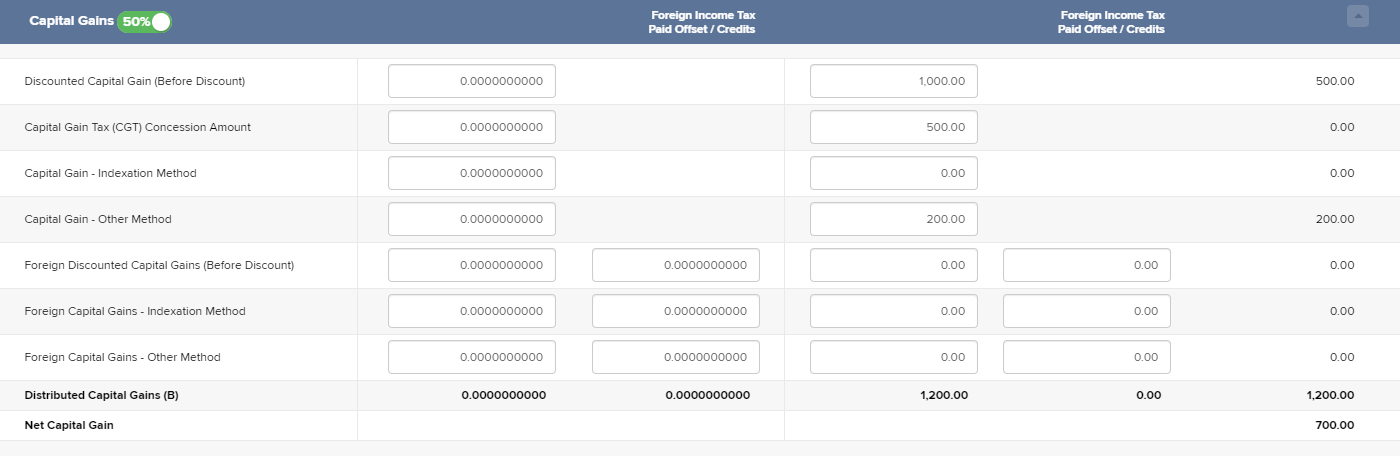

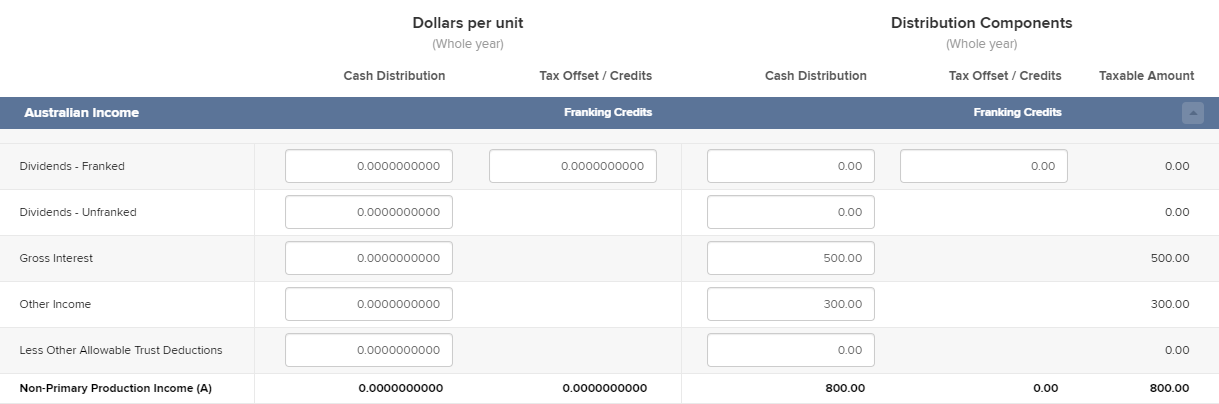

Examples How To Enter An Annual Tax Statement Simple Fund 360 Knowledge Centre

Examples How To Enter An Annual Tax Statement Simple Fund 360 Knowledge Centre

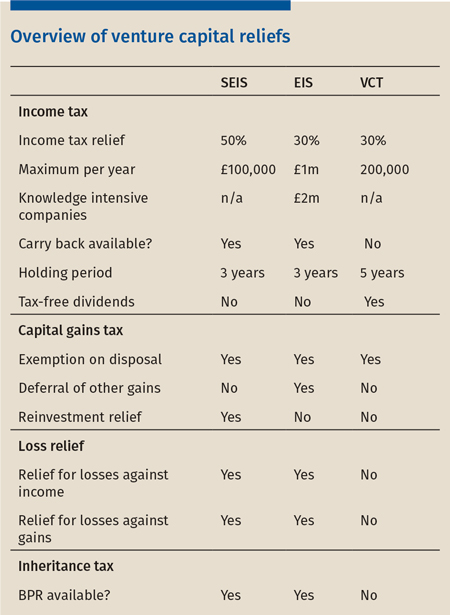

How To Handle Venture Capital Tax Reliefs

Dropping My Australian Residency What Are The Tax Implications

Leaving Australia To Live And Work Overseas Cgt Event I1 Deemed Disposal Of Investments Bdh Tax

What Is A Deemed Disposal Atlas Wealth Management

Amit Cost Base Net Amount Amma Statement Simple Fund 360 Knowledge Centre

1031 Exchange A Tax Deferred Way To Build Your Real Estate Business With Multifamily Syndication

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)